Articles

Yes, you could deposit inspections off their banks playing with Chase Mobile Deposit, provided the fresh view is made out over both you and is during You.S. cash. Chase requires the protection of its cellular financial services undoubtedly and you will makes use of certain tips to safeguard your data and you may transactions. The new Pursue Cellular software spends encoding technology to safeguard your data and requires verification to view your account. Concurrently, Chase checks for doubtful interest or unauthorized transactions to aid prevent ripoff.

Financial The united states Mobile Deposit Limit

There are particular constraints set up when it comes to mobile put constraints. Such, you learn the facts here now might not manage to deposit checks you to definitely exceed a great certain quantity or were altered by any means. To conclude, Woodforest Cellular Deposit Daily Restrict is an important element that assists protect the safety out of people’ profile and prevent con. Because of the understanding the everyday limit and pursuing the advice set forth from the Woodforest National Financial, people tends to make by far the most of the simpler cellular deposit ability. When the users have concerns otherwise concerns about its each day limitation otherwise mobile put as a whole, they should perhaps not think twice to get in touch with the financial institution for assistance.

Why must Your own Borrowing from the bank Merchant Give you A credit limit?

For those who have coins to put, try to visit a Chase part and rehearse their coin depending host. Sure, you will find constraints on the kind of monitors which are deposited, such as 3rd-party monitors or monitors made payable so you can somebody aside from the fresh membership manager. In case your cellular consider put try declined, Navy Government tend to inform you of one’s reason for the fresh rejection and supply tips on how to resubmit the fresh deposit. Sure, currency orders are approved to possess mobile put as long as they meet up with the borrowing from the bank partnership’s requirements. Financing are generally paid in this 1-dos working days, but handling moments may differ. If you wish to put forex, you will need to see a part place.

Temporarily, riskier assets including stocks or stock shared financing will get lose really worth. But over a long time panorama, background means that an excellent diversified gains collection can also be return an average out of 6% per year. There are no charge or minimums to start a free account, whether or not Varo is intimate a family savings if this has no balance to have nine days. When you yourself have at the least $a hundred within the savings, and would like to pair their family savings which have a no-percentage savings account that offers Atm reimbursements, then imagine signing up.

- As the invited incentives generally cover anything from $fifty to $a hundred, the simple terminology do for example also provides for example glamorous.

- On this page, we’re going to discuss the new Merrill Lynch mobile put limitation in detail, in addition to some fascinating information about this particular service.

- Zero, you can not put a for more than their Chase Cellular Deposit Restriction.

- No, checks that will be over half a year old are considered stale-dated and could never be approved to possess deposit.

- While we progress to the digital years, bank account are now able to become accessed which have an excellent thumbprint.

Out of old emperors protecting their beloved treasures to merchants within the medieval times securing aside its gold coins, the need to protect assets is as old because the society alone. Once we don’t element all the team, financial device, otherwise render readily available, all the information, reviews, and you can devices your’ll see for the Crediful derive from separate lookup. In this case, you would have to consult a good $step 3,one hundred thousand improve for the Pursue Cellular Deposit Restriction in order to reach your desired limit away from $5,100 per day. Financial of America ATMs are equipped with security measures to safeguard deposits, such encoding and fraud identification.

Charge card Limit To possess 31 one hundred thousand Income

But since your cash is in the stock exchange, there’s always the risk of losses. In case your account doesn’t give a high APY, you really must switch to a premier-produce savings account you to definitely really does. Not simply create a number of the better highest-yield offers profile shell out 5% interest, however offer a lot more. Already, there are 5% interest deals membership in the Lie Lender, UFB Lead, Salem Four Head, BMO Alto, Dough Savings, CIT Lender and you can Varo Lender. High-attention savings account might be a great equipment for getting far more money and you may preserving your fund h2o.

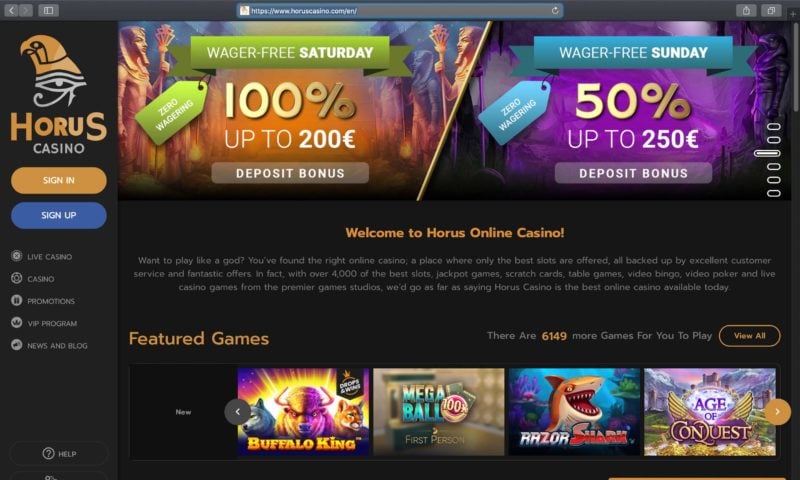

Easily Have An excellent $five hundred Credit limit Simply how much Must i Invest

Only keep in mind one , some place tips will most likely not performs to own distributions. It’s required to know even though online casinos is basically courtroom and you may legitimate, never assume all keep up with the exact same number of collateral and you may you are going to security. Type of casino other sites use up all your best qualification, can’t make up people because of their income, otherwise don’t prioritize customer satisfaction. Points try get you professionals as well as shorter cashouts and personal VIP executives. Your wear’t need getting a lengthy-identity citizen of your own condition playing – you just getting in person expose in to the state limitations whenever you’re playing. Online casinos explore professional geolocation technical to make certain conformity having county jurisdictional criteria.

Comentarios recientes